downloadhttps://tea-publican.org/wp-content/uploads/2023/03/A-better-way-to-Tax-Businesses.pdf

William Nunnally

The standard and off-used theory of increasing the tax on business is a shameful scam proposed by many politicians, most recently by Democrats. The majority of citizens know this is a ruse because the logical and most employed reaction of businesses is to raise the price of the products sold to cover the increase in taxes. Thus, the standard political approach to taxing businesses does not actually tax business, but increases the cost of everything to the consumer. In addition, taxing business profit does not affect the large wage gap between management and labor in most companies.

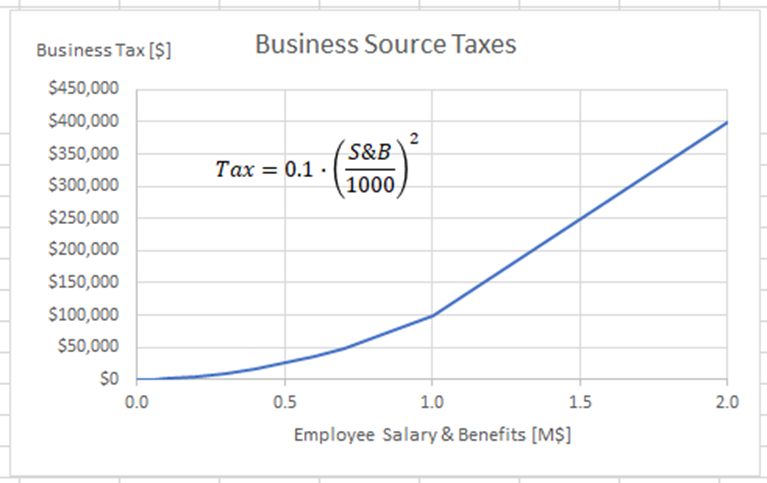

A much better approach in taxing economic systems is to tax the businesses for the labor they employ and let the business use profits for research and development and other activities that enhance jobs and the future of the business. This type of tax is a source tax, specifically a Labor Source Tax (LST). Any entity that is the source of income for a citizen would be taxed on the labor they employ. The Labor Source Tax can be progressive so that businesses are taxed more for higher paid employees.

For example, a business employing a CEO at a salary of $1,000,000 / year would be taxed at 40% of the DEO’s labor or a tax of %400,000. Thus the business would evaluate the value of higher psid employees to the business and hire and pay accordingly. A progressive source tax would structure the tax on employed labor so that the lower paid citizens would not require the business to pay tax. The following table is an example of a progressive Labor Source Tax (LST).