Supporting the creation of Wealth while Taxing Established Wealth

America is the land of opportunity which draws the innovators and entrepreneurs from the world. Those seeking wealth come to the US to seek their fortune and in the process generate jobs and wealth for all involved. The present problem is that the tax code taxes those seeing to grow wealth and does not tax those that have achieved wealth.

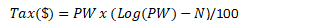

Therefore, a Paper Wealth Property Tax (PWPT) is proposed to tax those with extreme wealth while reducing the tax on those seeking to grow wealth in the economy. The PWPT is designed to tax those sources of paper wealth (PW) but not tax real property, which is allocated to the states. The PWPT rate equation is progressive as described by the equation:

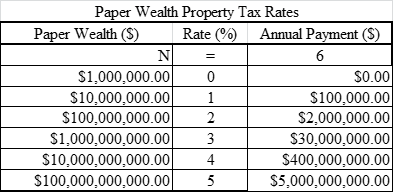

where N is the Log(paper wealth threshold), below which the PWPT is zero. For example, the range of annual taxes on established paper wealth are listed in the following table:

This tax amount is a small portion of the paper wealth which a wealthy person with the ability to employ investment personnel that should be able to sustain or even grow the fortune. In addition, there are no loop holes, set asides or ways to avoid PWPTs. However, the PWPT is progressive in that it restrains the grown of enormous fortune. In fact, the rates could be higher as determined by congress.

William Nunnally

Galveston, TX